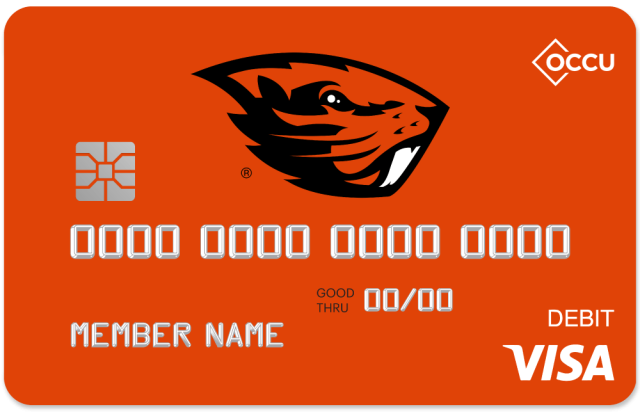

Beaver Debit Card

Show your Beaver devotion every day with the Beaver debit card

Breadcrumb

The debit card for Beaver Nation

Whether you’re a student, an alum or just a fan, you show your Beaver pride every day. Now, with the Beaver debit card from OCCU, you can show your team spirit every time you spend!

Already have a Remarkable Checking account? Request your card here.

We’ve got spirit, OSU!

With a Remarkable Checking account and Beaver debit card from OCCU, can enjoy free, secure, interest-earning1 checking that works hard for you. And when you use direct deposit with your Remarkable Checking account, you can get paid up to three days sooner.3

You’ll also have access to MyOCCU Online & Mobile, and can enjoy no monthly service fees, no minimum balance and free access to ATMs throughout the nation.2

Need even more to cheer about? The OCCU Beaver card is made from recycled plastic!

Meet three simple monthly qualifications to earn the highest interest:

- Make 12 cleared debit card transactions.

- Complete one direct or automatic deposit.

- Maintain active enrollment in eStatements.

If you don’t meet the qualifications, you can still make tracks toward your goals with 0.05% APY.

Open a Remarkable Checking account today and select the Beaver debit card!

We go wherever you go

MyOCCU Online & Mobile makes transferring funds, depositing checks and managing finances easy. Experience intuitive mobile banking with OCCU from your smartphone or tablet.

1Remarkable Checking annual percentage yield (APY): 2.00% APY applies to the first $20,000 and 2.00% - 0.20% APY on balances greater than $20,000 if all qualifications have been met. 0.05% APY on all balances if qualifying factors are not met. APYs effective as of 02/05/2026 and subject to change. Fees may reduce earnings.

2Foreign ATM fees charged by non-OCCU and non-Co-op financial institutions for the use of their ATMs will be automatically credited back to your account by OCCU at the end of the statement cycle. This credit is subject to meeting the qualifying factors. Statement Cycle = first day of the calendar month to the last day of the calendar month. Example: May 1 – May 31.

3 or **Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. OCCU may, but shall not be required to under any circumstances, make these funds available on the day the payment file is received, which may be up to three (3) days earlier than the scheduled payment date. OCCU does not assume any liability for not depositing these funds to your account early. OCCU may terminate early access at any time without notice.