Checking Page v2

Breadcrumb

Remarkable checking

Remarkable Checking invests in you with an introductory rate of 4.00% annual percentage yield (APY) on balances up to $20,000 ad .20% for balances greater than $20,000 for the first 6 months. Following the introductory period, you'll continue to get earnings of 2.00% APY every month on balances up to $20,000. And, our members with direct deposits automatically see deposits sent to your account up to three days early.

Intro for the first 6 months

after intro period

Maximize earnings by completing three simple monthly steps:

- Active enrolment in eStatements.

- Perform one direct deposit or automatic payment

- Make 12 debit card transactions

Not a member?

Not to worry. You'll become and Oregon Community Credit Union member in the process of opening your new account.

Reaching 12 swipes is easier than you might think:

- A trip to fill your gas tank.

- Grabbing a cup of coffee on your way to work.

- A visit to the grocery store.

These everyday transactions help you earn more and keep you on track to reach your financial goals.

1Remarkable Checking annual percentage yield (APY): 2.00% APY applies to the first $20,000 and 2.00% - 0.20% APY on balances greater than $20,000 if all qualifications have been met. 0.05% APY on all balances if qualifying factors are not met. APYs effective as of 05/06/2025 and subject to change. Fees may reduce earnings.

OCCU Member Benefits

Member and Owner - A $5 deposit secures your share in the credit union, making you a member and owner.

Online Banking - Transactions and other financial business can be done online, on your mobile device, in person or on the phone—whatever is most convenient for you!

Shared Branching - Conduct transactions at thousands of credit unions nationwide.

Free ATMs - Access to over 30,000 surcharge-free CO-OP Network ATMs nationwide.

Complimentary identity theft protection through Identity Fraud, Inc., available to all members with a checking account. Additional protection available.

Early deposits – Get rewarded with direct deposits automatically sent to your account up to three days early.*

Regular FREE financial seminars on first-time home buying, paying for college, protecting yourself from financial crimes and other subjects.

FREE access to BALANCE - a personal financial education center providing online courses on everything from money management to the basics of investing.

Learn more about BALANCE

Accidental Death and Dismemberment insurance at a basic level with additional coverage available at competitive rates.

TruStage™ Accidental Death & Dismemberment Insurance

Federal insurance program for qualified deposits through National Credit Union Administration (NCUA).

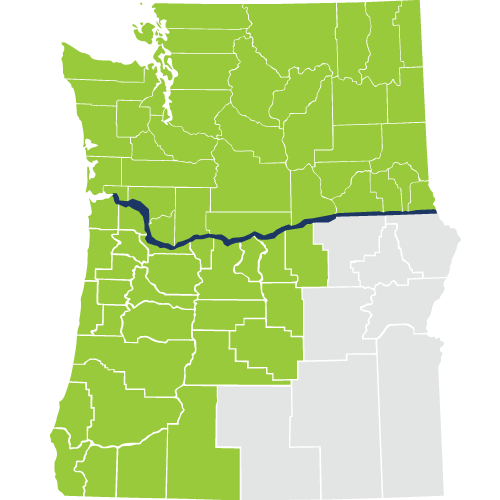

- Lives or works in our 67-county membership area.

- Is an immediate family member of an OCCU member or someone living in the membership area.

- Is a student or employee of the University of Oregon or member of the UO Alumni Association.

- Is employed by Bi-Mart or is an immediate family member of an employee.

- Is a Bi-Mart store member or an immediate family member of a store member.

- Is employed by the State of Oregon.

Let's make this happen! You'll become a member by applying for any OCCU account. Join now online or stop by any branch to become an OCCU member today.

Questions about accounts

Lorem ipsum

Questions about Debit Cards

Lorem ipsum

Questions about Membership

Lorem ipsum