Keep it secure with Remarkable Checking

Breadcrumb

We check all the boxes:

Safe

Your money is secure and insured.

2.00 %

APY1

Free

No ATM fees2 or minimum balance

The details:

There’s no minimum balance, no monthly fees. Just three simple monthly qualifications:

- Maintain active enrollment in eStatements.

- Make one automated transaction.

- Make 12 cleared debit transactions.

Your account will come with a free debit card, and any month you miss your qualifications you'll still receive a default rate of 0.5% APY1.

We're like a bank, but better

Opening a Remarkable Checking account will make you an official member of OCCU.

- We're not-for-profit, investing money back into the community via scholarships, grants, low fees, and generous rates.

- Credit unions are owned by its members and represented by a board that YOU vote for.

Member Benefits

From free access to nationwide ATMs to complimentary identify theft protection, the services that bring peace of mind come standard.

Member and Owner - A $5 deposit secures your share in the credit union, making you a member and owner.

Online Banking - Transactions and other financial business can be done online, on your mobile device, in person or on the phone—whatever is most convenient for you!

Shared Branching - Conduct transactions at thousands of credit unions nationwide.

Free ATMs - Access to over 30,000 surcharge-free CO-OP Network ATMs nationwide.

Complimentary identity theft protection through Identity Fraud, Inc., available to all members with a checking account. Additional protection available.

Early deposits – Get rewarded with direct deposits automatically sent to your account up to three days early.*

Regular FREE financial seminars on first-time home buying, paying for college, protecting yourself from financial crimes and other subjects.

FREE access to BALANCE - a personal financial education center providing online courses on everything from money management to the basics of investing.

Learn more about BALANCE

Accidental Death and Dismemberment insurance at a basic level with additional coverage available at competitive rates.

TruStage™ Accidental Death & Dismemberment Insurance

Federal insurance program for qualified deposits through National Credit Union Administration (NCUA).

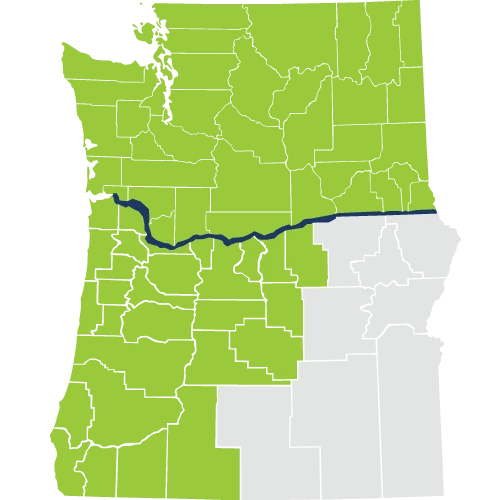

Who qualifies for membership?

Members must meet one of the following qualifications:

-

Lives or works in one of our Oregon or Washington counties.

-

Is an immediate family member of an OCCU member or someone living in the membership area.

-

Is a student at or employed by the University of Oregon or member of the UO Alumni Association.

-

Is employed by or a store member at Bi-Mart or an immediate family member of a store employee or member.

-

Is employed by the State of Oregon.

1Remarkable Checking annual percentage yield (APY): 2.00% APY applies to the first $20,000 and 2.00% - 0.20% APY on balances greater than $20,000 if all qualifications have been met. 0.05% APY on all balances if qualifying factors are not met. APYs effective as of 05/06/2025 and subject to change. Fees may reduce earnings.

2Foreign ATM fees charged by non-OCCU and non-Co-op financial institutions for the use of their ATMs will be automatically credited back to your account by OCCU at the end of the statement cycle. This credit is subject to meeting the qualifying factors. Statement Cycle = first day of the calendar month to the last day of the calendar month. Example: May 1 – May 31.