2022 Annual Report

Breadcrumb

Where action meets passion

In 2022, OCCU focused on being a force for good and we thank our members for counting on us to be a trusted partner in their financial journey.

Our members are our why

We strive to find new ways to help our members along their financial journey, no matter where they’re starting or where they’re headed.

- Why we built fee-savings programs and returned more than $1.2 million to members in 2022.

- Why we improved our members’ credit card experience with tap-to-pay technology and online and mobile banking integration.

- Why we paid $13,481,055 in dividends to members in 2022.

- Why we shared nearly 50 educational articles, videos and seminars about banking safely and financial empowerment.

- Why we offer member impact loans with competitive rates and flexible repayment terms for those facing financial hardships.

- Why we introduced video tellers at all ATMs.

- Why we built a new career-path support program and enhanced our internal training for our team members.

57,258

new members.

260,993

total members.

895

member impact loans, totaling $4.1 million. When a member is facing a financial hardship, a small loan with a fair rate can make a big difference.

$1.2 million

in fee savings returned to our members.

2,406

members and clients supported by our investment services team.

62,313

auto, motorcycle, RV and boat loans.

Expanding and improving for you

We’re always searching for new ways to reach our members and bring more of the Pacific Northwest into the OCCU community. That’s why we now offer mortgage loans in the state of Washington!

In Oregon, we opened a new branch in Junction City in 2022, with a Redmond branch following close behind in early 2023. Looking ahead, we have plans for new branches to serve our members in Roseburg, Cottage Grove and Corvallis.

Our digital presence continues to grow as well. Our new video tellers combine the personalized service of a branch visit with the convenience of an ATM. And we've enhanced our online and mobile banking platform so you can manage your money and bring us with you wherever you go.

We’ve expanded our reach to our members, adding more branch locations as well as improved online and mobile banking services. This has allowed us to meet our members wherever they are, so they can access their accounts and manage their money at home or on the go.

940,000

branch transactions.

254,000

phone interactions with our member contact center team.

23 million

debit and credit card transactions.

5 million

MyOCCU Online & Mobile transfers.

411,600

mobile deposits.

7.5 million

page views on MyOCCU.org.

OCCU was the only local financial institution consistently in the top ten mortgage companies by volume and dollar value in Lane County, OR.

672

mortgage loans in Oregon and Washington.

$230 million

in mortgage loans.

In the community

We volunteered our time, skills and resources to help our communities thrive.

One of our biggest events was Shred Fest 2022, which gave people an opportunity to safely destroy their sensitive documents and donate food to help their neighbors in need.

- 45+ employee volunteers.

- 9,000 pounds of paper shredded.

- 600 households served through our drive-up location.

- 1,600 pounds of food donated to St. Vincent de Paul food pantries.

945

employee volunteer hours at non-profits and schools.

$185,064

in donations, community support and sponsorships.

OCCU Foundation

OCCU Foundation partnered with 45 organizations, giving $919,497 to build happier and healthier communities.

- $225,750 scholarships funded.

- $216,250 grants to support community building programs.

- $454,497 to support health initiatives.

Inaugural OCCU Foundation Golf Classic raised more than $190,000 to support programs working to alleviate childhood hunger.

Some of the OCCU Foundation's top funded partners in 2022 include:

- American Cancer Society

- Bethel Education Foundation

- Blessings in a Backpack

- Boys and Girls Club of Emerald Valley

- Bushnell University

- DevNW

- Education Together Foundation

- Eugene Family YMCA

- Food for Lane County

- Marion Polk Food Share

- McKenzie Fire and Rescue

- PeaceHealth Sacred Heart Medical Center Foundation

- Ronald McDonald House Charities

- University of Oregon Foundation

OCCU was honored to be recognized by its members, community, team members and peers in 2022.

- 2022 Register-Guard’s Readers’ Choice Finalist in the Credit Union category as voted on by readers.

- Portland Business Journal 100 Best Companies to Work for 2022 (as voted on by team members), Corporate Philanthropy and Most Admired Company lists.

- 2022 Bold Steps award finalist, recognizing businesses that are leaders in sustainability.

- 2022 Prominent Partner award from Ronald McDonald House Charities of Oregon and Southwest Washington.

- 2022 Springfield Chamber of Commerce Employer of the Year.

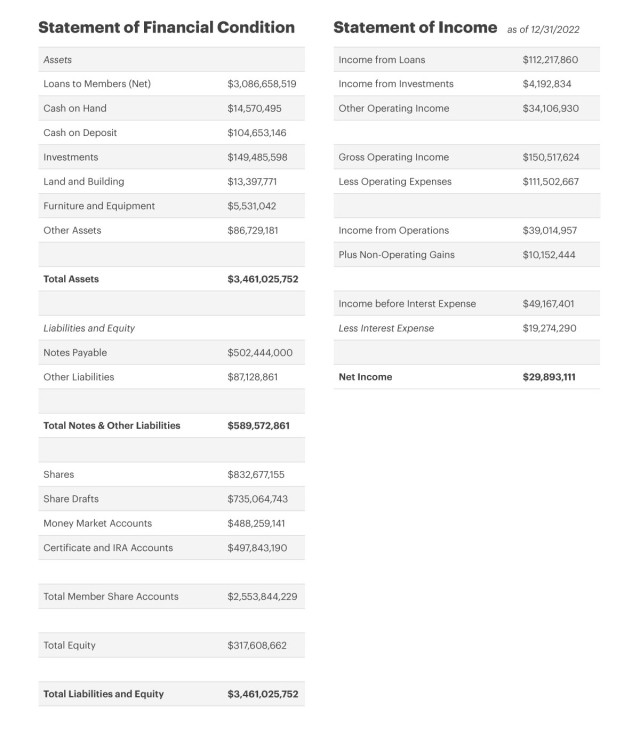

2022 Financial Summary

Chair and CEO report

JEANINE JENSEN, Board Chair and RON NEUMANN, President & CEO

Read OCCU's Chair & CEO Report

We are happy to report that OCCU is a healthy and growing financial institution. Through the unprecedented changes in the market and the continuously rising interest rate environment, we have continued to thrive.

In 2022 we welcomed more than 57,000 new members and our assets grew to $3.46 billion. This growth has allowed us to continue our investments in the membership by adding branch locations and interactive video teller machines, enhancing our digital channels and introducing new products and services to meet your evolving needs.

The entire OCCU team holds strong to our vision to enrich lives and works diligently to ensure that we exceed your expectations as a financial partner. This includes paying top of market rates on deposit accounts such as Remarkable Checking and Ignite Savings and offering competitive rates on loans, all with lower and fewer fees than other financial institutions.

As we look ahead to 2023 and beyond, we are excited about the opportunity to improve your experience, bring you additional ways to interact with OCCU and provide other service enhancements.

- We are expanding our physical presence with new branch locations. In the first quarter of this year, we opened a full-service location in Redmond, OR and we will join the Roseburg, OR community this summer. We are hopeful that two additional locations in the Willamette Valley will be added by early 2024.

- We will continue to enhance our digital, phone and self-serve channels to allow you to do business with us when it is convenient for you.

- Mid-year, we will convert our debit card platform to a new processor. This change will allow us to improve and optimize your experience and bring contactless, tap-to-pay functionality and advanced fraud detection and prevention capabilities to your debit card.

- We are offering our new home and auto insurance products to provide you affordable alternatives to bring you peace of mind.

- Through the OCCU Foundation, we will expand our support and investment in the work of nonprofit organizations throughout our communities.

These are just a few of the exciting things we are working on in the year ahead. We remain committed to enhancing your OCCU experience and delivering exceptional service as we look for additional ways to enrich the lives of those around us and add even more value to your membership.

We are humbled that you have selected us as your financial partner. On behalf of the Board of Directors and our more than 600 employees, we would like to say thank you for your membership and engagement in our cooperative. It is our sincere hope that we have enriched your life in a meaningful way.

In gratitude,

Jeanine Jensen

Board Chair

Ron Neumann

President &CEO

A commitment to safety and soundness

JACKIE RICE, Supervisory Committee Chair

Read OCCU's Supervisory Committee Report >>

OCCU’s Supervisory Committee is appointed by the OCCU Board of Directors from among the members of OCCU. The Committee acts as our members’ representative in ensuring that an annual overall financial audit and verification of members’ accounts is performed and that the credit union has adequate internal controls to provide for the safety of member assets. The Committee reviews all audits and reports any significant findings to the Board of Directors.

The annual financial audit and verification of members’ accounts for 2022 were completed by professional services firm Moss Adams with an effective date of June 30, 2022. Their formal opinion letter confirmed that the financial statements fairly represent the credit union’s financial position.

In addition to the verification of members’ accounts and annual financial audit, the Committee also reviews all internal audits. In 2022, these audits were performed by the firm FORVIS. The Committee is appreciative that OCCU management continues to respond promptly to mitigate any operational issues as they arise.

On behalf of the Supervisory Committee, I would like to thank the Board of Directors, management and staff for their work. Their efforts are greatly appreciated.

Jackie Rice

Chair

Meet our team

BOARD OF DIRECTORS

Jeanine Jensen

Chair

Bill Inge

Vice Chair

Beverly Anderson

Director

Tom Larson

Director

Genevieve Parker

Director

Jacob Siegel

Director

Ron Neumann

Treasurer, OCCU President & CEO

ASSOCIATE BOARD MEMBERS

Brandon Rogers

Scott Smith

SUPERVISORY COMMITTEE

Jackie Rice

Chair

Justin Freeman

Vice Chair

Ellen Manzer

Jered Souder

LEADERSHIP TEAM

Chief officers

Ron Neumann

President & CEO

Greg Schumacher

Executive Vice President

Brian Alfano

Chief Digital Officer

Russ Bernardo

Chief Lending Officer

Heather Billings

Chief Marketing Officer

Tracey Keffer

Chief Operating Officer

Senior leadership

Terri Baker

VP of Member Support

Rich Black

VP of Indirect Lending

Dan English

Director of Technology Services

Steven Epling

Director of Credit Services

Casey Foltz

Senior VP of Analytics & Profitability

Lacey Green

Director of Executive Services

Aris Jerahian

VP of Digital & Payment Services

Brian Killingsworth

VP of Technology Services

Cherie Kistner

Director of Corporate Communications

Chelsy McNeil

Director of Digital Experience

Angelica Murillo

VP of Regulatory Compliance

Ethan Nelson

VP of Credit Administration

Lindsey Roberts

VP of Mortgage Lending

Brandy Rodtsbrooks

Director of Marketing

Dave Schiffer

Senior VP of Finance & Credit

Kirsten Simmons

Senior VP of People Experience

Cheleana Stafflund

Director of Retail Operations

Genevieve Sumnall

VP of Business Services

Chris Whittaker

Senior VP of Indirect Lending

Matthew Wilson

VP of Risk & Administration

Greg Young

VP of Insurance Services

CORPORATE OFFICES

2880 Chad Drive

Eugene, OR 97408

800.365.1111 | MyOCCU.org

View previous annual reports